Read Also

Your Application is Mostly Written by Strangers

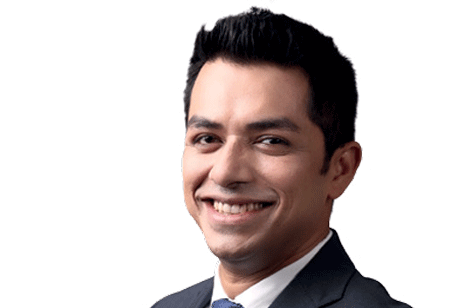

Edwin Kwan, Head of Application and Software Security at Tyro Payments

ESG Performance - Why It's Crucial To Future Success

Jo-Anne Ruhl, vice president and managing director, Workday Australia and New Zealand.

Enterprise Digital Transformation is not for the faint hearted: Guiding principles for a enterprise-wide digital transformation

Linda Zeelie, Enterprise Digital Transformation Architect and Leader, Metlife and Nina Evans (Professorial lead: UniSA STEM, University of South Australia (UniSA))